How Understanding Bankruptcy: How It Works & What To Know can Save You Time, Stress, and Money.

You're resting at the kitchen table, gazing down collection notifications and questioning just how you're mosting likely to make points job. Possibly you've recently shed your task and also the financial debt is stacking up to an overwhelming quantity. And afterwards you assume itthat word you never ever believed you would certainly need to consider: insolvency. Often your situation seems so hopeless that bankruptcy resembles your only choice.

It is necessary to understand exactly what bankruptcy is and also what the various kinds of insolvencies are so you can make the ideal decision for your circumstance. Even more than just a method to shed a game of Monopoly, personal bankruptcy in reality is a whole lot more significant: It's when you precede a judge as well as inform them you can't pay your financial obligations.

It is necessary to understand exactly what bankruptcy is and also what the various kinds of insolvencies are so you can make the ideal decision for your circumstance. Even more than just a method to shed a game of Monopoly, personal bankruptcy in reality is a whole lot more significant: It's when you precede a judge as well as inform them you can't pay your financial obligations.There are a number of reasons that individuals apply for bankruptcythings like a task loss, a divorce, a medical emergency or a fatality in the family. In fact, greater than 730,000 nonbusiness personal bankruptcies were submitted in 2018. bankruptcy attorney near me.1 That's crazy! Yet insolvency is a major life event that impacts more than just your financial resources.

The Basic Principles Of Are You Thinking About Bankruptcy?

Although individuals might see it as a "fresh beginning," insolvency just treats the signs, not the issue. It's additionally essential to understand that bankruptcy does not clear trainee lendings, national debt (taxes, penalties or fines), declared financial debt (where you recommit to the regards to a current lending), child assistance or spousal support.

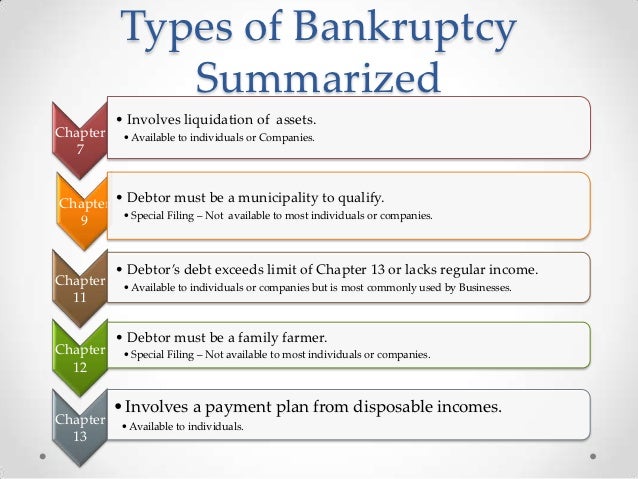

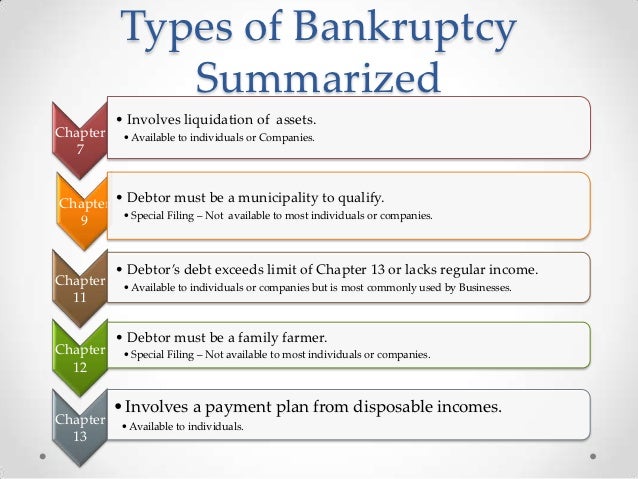

Even though the basic objective of bankruptcy is to clear debt, not all insolvencies are created equal. Actually, there are six various kinds of personal bankruptcies: Phase 7: Liquidation Phase 13: Repayment Strategy Phase 11: Large Reorganization Chapter 12: Family Members Farmers Chapter 15: Used in Foreign Situations Phase 9: Towns You might have just taken one look at this list and also zoned out for second.

Even though the basic objective of bankruptcy is to clear debt, not all insolvencies are created equal. Actually, there are six various kinds of personal bankruptcies: Phase 7: Liquidation Phase 13: Repayment Strategy Phase 11: Large Reorganization Chapter 12: Family Members Farmers Chapter 15: Used in Foreign Situations Phase 9: Towns You might have just taken one look at this list and also zoned out for second.Even more than likely, you would only be dealing with both most usual kinds of insolvencies for people: Phase 7 and Chapter 13. (A chapter simply refers to the particular area of the UNITED STATE Personal Bankruptcy Code where the regulation is located.2) But we'll have a look at each type so you're familiar with the options.

bankruptcy firm near me :both" id="content-section-2">Not known Incorrect Statements About A Guide To Bankruptcy

A court-appointed trustee supervises the liquidation (sale) of your properties (anything you have that has value) to settle your financial institutions (the people you owe cash to). Any remaining unprotected financial obligation (like bank card or medical expenses) is typically erased. But as we stated earlier, this does not include the kinds of financial debt that aren't forgiven via insolvency, such as student financings as well as taxes.

As an example, lots of people have the ability to hang on to fundamental necessities like their house, vehicle and also retired life accounts during Chapter 7 insolvency, but absolutely nothing is guaranteed. Chapter 7 additionally can not stop a foreclosureit can just delay it. The only way to maintain right stuff you still owe cash on is to declare the financial debt, which implies you recommit to the financing arrangement and also proceed making payments.

You can only submit for Phase 7 bankruptcy if the court decides you don't make enough money to pay back your financial obligation. This choice is based upon the means test, which compares your revenue to the state average as well as checks out your finances to see if you have the non reusable revenue (also known as the means) to pay back a respectable quantity of what you owe to lenders. bankruptcy attorney near me.

The Understanding Chapter 7, 11, And 13 Bankruptcy Diaries

Maintain in mind that if you declare Phase 7 insolvency, you will certainly need to go to a meeting of the creditors where people you owe money to can ask you all type of concerns concerning your debt and your finances. Yeah, that has to do with as fun as it seems. A Phase 7 insolvency likewise remains on your credit scores record for one decade, and you will not be able to apply for it once again until after eight years.

The court accepts a month-to-month layaway plan so you can repay a portion of your unsecured debt as well as all of your secured financial debt over a duration of 3 to 5 years. The month-to-month payment amounts rely on your income and also the amount of debt you have. But the court also gets to place you on a rigorous budget and inspect all your costs (oops!).

Quinlan Law Group, LLC

Address: 2331 Market St, Camp Hill, PA 17011, United StatesPhone: 717-202-2277

Click here to learn more